Western Imperialism and the Role of Sub-imperialism in the Global South

At first blush, Joe Biden’s election as U.S. president brings respite from a world threatened by Donald Trump’s climate-denialist, dictator-coddling, xenophobic, racist, misogynist, rules-breaking regime. On second thought, 2021 will also initiate an unwelcome restoration of legitimacy to Western imperialism akin to Barack Obama’s rule. Biden’s (2020) recent Foreign Affairs article began by stressing how since 2017, “the international system that the United States so carefully constructed is coming apart at the seams.” In reconstructing imperialism, Biden may draw upon a legislative and public-advocacy record dating to the 1980s, based upon consistent service to several internationally ambitious circuits of U.S. capital:

finance, for example through supporting bankruptcy “reform,” austerity in social programs, the Gramm-Leach-Bliley Act deregulating Wall Street, and unprecedented financial-sector bailouts;

merchant and agribusiness, when promoting trade and “investor rights” deals;

technology, through unleashing Big Data surveillance;

medicine and insurance, when favoring intellectual property and opposing public financing of health care;

fossil fuel, given that his climate policy will resurrect Obama’s, based on insufficient emissions reductions, ongoing oil and gas drilling and pipeline transport, a refusal to pay the U.S. climate debt, and renewed reliance upon carbon markets; and

the military-industrial complex, for Biden supported every war since the 1980s, leading the authoritative insider journal Defense One to celebrate, “Biden may not radically change the nation’s military, deviate from the era’s so-called great power competition, or even slash the bottom line of the Pentagon’s $700 billion budget” (Benjamin and Davies 2020).

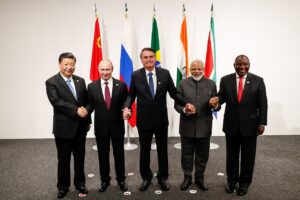

What will stand in opposition to a Biden-administration imperialism, whose toxic ideology only replaces Trump’s “paleoconservative” nationalism with the Obama-style fusion of neoliberalism and neoconservatism? Much hope was invested in the Latin American “Pink Tide” but it faded after Hugo Chavez’s 2013 death (with Venezuela’s subsequent Maduro government surviving but suffering enormously from U.S. sanctions, whereas Bolivia’s Movement Towards Socialism returned to power in 2020 after a coup backed by Trump and lithium-dependent battery producer Elon Musk). Since then, notwithstanding serious crises, the Brazil-Russia-India-China-South Africa (BRICS) network has been of central interest in twenty-first-century international political economy.

This group of countries from the Global South (and East) gathered momentum after Goldman Sachs banker Jim O’Neill initially conceived the acronym BRIC in 2001 (not including South Africa) in order to identify promising markets. However, it was the U.S.-catalyzed financial meltdown in 2008 that gave the BRIC states more credibility as “rising powers.” “Core” countries were losing political-economic power on the world stage, while China, along with other so-called “emerging economies,” would challenge the dominant position of the United States, Europe, and Japan.

That economic crash also consolidated the G20, assimilating all five BRIC nations into the reflation of the global economy, based initially upon both an unprecedented infrastructure build-out in China and Western central bank quantitative easing plus International Monetary Fund (IMF) funding. In 2009, the first BRIC summit took place in Russia, starting a succession of annual summits that gave body and content to the group. China invited South Africa to join in late 2010.

Despite annual displays of cooperation through leadership summits and hundreds of side meetings, there are still significant asymmetries between these five countries, witnessed, for instance, in trade relations. Brazil, Russia, and South Africa are highly dependent on commodities exports, such as grains, crude oil, metals, and ore, with China a major buyer. In turn, exports from China to other BRICS nations are made up of manufactured and semi-manufactured products, creating major trade and financial deficits. A form of the classic North-South manufacturing-commodity function within the international division of labor appears to be reinforced by trade relations among the bloc’s members.

If such a tendency can arise inside the bloc, BRICS countries’ foreign direct investment (FDI), trade, and credit are even more pernicious in the Global South, especially Africa, Latin America, and the Caribbean. Ultimately, we question whether BRICS is capable of reversing historical, unequal relations of trade and investment between the “core” and “peripheries,” and we identify, in some cases, an uncomfortable middle ground: “sub-imperialism.”

We conclude that BRICS will therefore fail to promote new development practices that could lead to a more environmentally sustainable and socially just model. To the contrary, BRICS nations appear to be reinforcing old patterns of underdevelopment that amplify extraction of natural resources, which in turn results in adverse impacts for local communities, workers, and nature. Although the COVID-19 crisis interrupted many aspects of global capitalism, these features appear more durable.

Despite a potentially constructive geopolitical role that can be played by BRICS members (particularly China) in terms of balancing U.S. hegemony and providing competition to the Western corporations that have dominated FDI in the Global South, BRICS firms’ presence there suggests the earlier expectations were overly optimistic. From the standpoint of individual peripheral countries, the current role being played by BRICS, it seems, is a force of continuity and legitimator of the global capitalist power structure, rather than one of change.

BRICS and Competing Theories of Development

Among diverse analyses of BRICS over the past decade, leading geopolitical analyst Radhika Desai (2013) was perhaps most enthusiastic: “Not since the Non-Aligned Movement and the demand for a New Economic Order in the 1970s has the world seen such a coordinated challenge to Western supremacy in the world economy from developing countries.” Some analysts even expressed hope for a “new Bandung” in the twenty-first century, referring to a 1955 conference of 29 African and Asian countries that created the Non-Aligned Movement of 120 states (Bisio 2015, Zakaria 2013). More realistically, for Walden Bello (2014), the BRICS countries were beneficiaries of a corporate-driven globalization, “owing their rise to the marriage of global capital and cheap labor” in export-oriented manufacturing and extractive sectors. Kees van der Pijl (2017) even considered the BRICS nations as contender regimes, in the form of state-oligarchic rivals to the liberal West.

Some BRICS leaders have endorsed such a view in order to score political points with domestic constituencies. Most crudely, former South African President Jacob Zuma claimed repeatedly, “I was poisoned and almost died just because South Africa joined BRICS under my leadership” (Matiwane 2017). According to Brazil’s former Foreign Minister Celso Amorim, “BRICS corresponded with the rearrangement of global economic forces, especially after the 2008 financial crisis, and became notorious thanks to the redistribution of decision-making power within the IMF in favor of its members” (Amorim and Feldman 2011: 286).

However, it is important to ask whether greater voting power within the IMF marked BRICS as a progressive force or instead as an ally of the Global North. European neoliberal leadership and ongoing commitments to the Washington consensus menu of pro-corporate economic policy prevailed at the IMF after 2015, when four BRICS members achieved much greater influence following voting-weight restructuring (only South Africa’s share dropped).

This should not have been a surprise, for as Ray Kiely (2015: 2-3) argued, BRICS’ rise “owes less to state capitalist deviations from neoliberal prescriptions [that] originated in the West, and more to the embrace of globalization friendly policies.” Vijay Prashad (2013:3) termed the BRICS agenda “neoliberalism with Southern characteristics. … There is no frontal challenge to Northern institutional hegemony or to the neoliberal policy framework. BRICS, as of now, is a conservative attempt by the Southern powerhouses to earn themselves what they see as their rightful place on the world stage.”

But there is an even more critical characterization: the BRICS nations as “sub-imperial” powers, featuring the super-exploitation of their working classes, predatory relations regarding their hinterlands, and collaboration (although tensioned) with imperialism, especially as intermediaries in the transfer of both surplus labor values and “free gifts of nature” (unequal ecological exchange) from South to North. BRICS members’ role in multilateral governance is not anti-imperialist as sometimes advertised but instead consistent with what Immanuel Wallerstein called the “semi-peripheral” economies’ aspirations to follow Western expansionary precedents, using instruments of (corporate-oriented) multilateral power.

David Harvey (2001) observed that, just like imperial powers, new centers of capital overaccumulation need spatio-temporal fixes for their own surpluses that could not be as profitably invested at home. China’s industrial overcapacity crisis is most obvious, but this condition extends to both imperialist and sub-imperialist practices “dispersed through an uneven geography of capital surplus distribution” (Harvey, 2007). In a recent debate over the character of contemporary imperialism, Harvey (2018) remarked how mineral and agricultural commodity chains, extractivism, and land grabs that follow BRICS firms’ expansions—especially Beijing’s Belt and Road Initiative—are “wrecking the landscape all around the world.” A rigid and fixed concept of “North-South imperialism” can’t account for ever more complex “spatial, inter-territorial, and space-specific forms of production, realization, and circulation” of surplus capital overaccumulated in middle-tier economies, Harvey (2018) insists. This is not an abandonment of Rosa Luxemburg’s (1968) 1913 theory of imperialism but an adaptation for new circumstances.

Likewise, influential Latin American and African theories of underdevelopment deserve revisiting. At the UN Economic Commission for Latin America and the Caribbean (ECLAC), Argentine diplomat Raúl Prebisch formulated a non-Western view of development economics, taking his insights to the UN Conference on Development and Trade, which in the 1970s was the launchpad for the New International Economic Order proposals (Letelier and Moffit, 1977). Prebisch used the core-periphery model to challenge Ricardian notions of comparative advantage and to promote policies that were attractive to trade unions, progressive social movements, the center left, and patriotic businesses and policy-makers. By condemning poor countries’ specialization in exporting raw materials—which in turn led to declining terms of trade—Prebisch (1950, 10) showed how “fruits of technical progress” were disproportionately enjoyed by industrialized economies and societies.

In Africa, the most advanced first-generation liberation movement leaders (such as Kwame Nkrumah, Julius Nyerere, and Samora Machel) agreed that neocolonial economic relations needed to be broken, resulting in the 1979 Lagos Plan of Action adopted by the Organization of African Unity (but rapidly sabotaged by the Bretton Woods Institutions; Bond 2006). The Egyptian political economist Samir Amin (1990) contributed a theory and program of strategic “delinking.”

In Latin America, the next generation of Dependency School perspectives drew on the core-periphery model but also explained “limits of industrialization” in the South—which Prebisch (1950: 6) himself had already warned of. The emerging critique was not restricted to trade relations alone but included a whole “structure of dependence,” as argued by Theotônio dos Santos (1970). Contrary to the dominant modernization theories, especially U.S. State Department strategist Walt Rostow’s (1960) “stages of economic growth,” Santos (1970, 235) insisted that “to analyze backwardness as a failure to assimilate more advanced modes of production or to modernize is nothing more than ideology disguised as science.”

Within the Marxist strand of dependency theories, Ruy Mauro Marini (1965; 1972) explained how Southern elites engaged in a so-called “antagonistic cooperation” (Marini 1965: 12) with capitalist centers of accumulation. He added that the “super-exploitation of labor” was retained under dependency due to the need to extract super-profits enough to satisfy both the revenue expectations of international capitalists and the share that corresponds to their minor associates in the periphery and semi-periphery (Marini 1972, 23). One possible outcome was the evolution toward what Marini (1972, 15) dubbed “sub-imperialism,” a concept designating “the form which dependent capitalism assumes upon reaching the stage of monopolies and finance capital” (original emphasis).

Watching the debate unfold from Senegal, Amin (1974, 22) agreed that Marini’s theory “addresses a very real problem raised here: that of inequality in peripheral development.” If light industry arises in sub-imperial economies (including in Africa), it means “producing not only for their ‘national’ market but also for those of neighboring areas.” In the intervening period, the most destructive circuits of international capital were amplified, suffocating all but a few Global South break-out spaces (especially the newly industrializing countries of East Asia), several of which became more actively sub-imperial as a transmission belt to the world economy, suffocating their own neighbors in the process.

Overall, dependency theories were able to show that neither industrialization to the level of monopolies nor high levels of economic growth by themselves would automatically reverse the trend toward underdevelopment or to a very distorted kind of development, one that crystalizes inequalities instead of mitigating them. “Brazilian capitalism is a monster,” Marini (1972, 20) declared, “but a logical monster.” He explained the coexistence of advanced technology and a sizable luxury goods market alongside the vast majority’s misery. Import-substitution industrialization strategies in postwar Brazil and South Africa were, in particular, biased toward supplying Western-quality consumer goods to a small market within the context of the world’s worst inequality (Nixson 1982).

Unlike the traditions of ECLAC or dependency theory, which took the desirability of development for granted, a recent movement encompassing both academic and activist worlds aims to abandon modernizing ambitions in favor of a different, non-Western paradigm, such as the Buen Vivir (Living Well) concept articulated by indigenous peoples from the Andean region. Although it constitutes a plural movement, still under construction, this post-developmentalist critique has been gaining momentum in the past two decades, mainly due to the attention given to resistance by local communities against infrastructure megaprojects threatening their livelihoods and the surrounding environments (Gudynas 2013, Swampa 2013, Escobar 2015, Kothari et al. 2019).

Also in this tradition, Aníbal Quijano (1992) introduced the concept of “coloniality of power,” since development had become a “ghost” haunting elite consciences in most Latin American capitals, preventing the return of normative ideals able to inspire their own societies (Quijano 2012, 77). If the notion of development cannot escape its Eurocentric roots, as Quijano argues, then it is mandatory to formulate an “alternative mode of existence, as the de/ coloniality of power” (Quijano 2012: 42), such as Buen Vivir. The same is true in many African societies where some advocate a return to “Ubuntu” mutual aid systems as well as societal reintegration within local ecologies—instead of ongoing, fruitless efforts at modernization (Terreblanche 2018).

BRICS Firms Expand, Firmly Within—Not Against—the Capitalist World Order

This reminder of the big-picture development debates compels us to critique the BRICS nations’ role: Instead of being supportive of alternative approaches, their economic relationship to the rest of the Global South reinforces the traditional international division of labor through FDI and credit, in projects directed to the extraction of natural resources (oil, gas, minerals), and infrastructure related to them. Some might term this process the amplification of uneven development: a situation in which Western, dependency-inducing neocolonialism combines capitalist and non-capitalist relations, as Luxemburg (1968) argued. In today’s “post-colonial” world, there are equally extreme forms in many sites where BRICS-based firms and geopoliticians are the main actors.

China is the world’s largest economy (measured in purchasing power parity) and the main power within BRICS. Chinese foreign investment went through different phases: In the 1990s and early 2000s, it was characterized by large state-owned enterprises’ acquisitions focused on natural resources, especially energy and mining. After the 2008-2009 Western financial meltdown reinforced rising Chinese power, BRICS surfaced amidst the growing presence of the country’s private multinationals, including increased investments in extractive industries but also technology, manufacturing, financial services, and real estate.

Today, China’s Belt and Road Initiative has gone beyond Asia and Europe and has included 40 countries in Africa and 18 in Latin America. It offers recipients major infrastructure projects and credit lines (Zhang 2019; Dollar, 2019). Both phases, however, reproduced capitalism’s traditional core-periphery dichotomy: While investments in Latin America and Africa are concentrated in energy, natural resources, and related infrastructures, investments in the United States and Europe are directed to services, telecommunications, media, and high-level manufacturing (Jaguaribe 2018: 22-23).

China leads the BRICS nations’ presence in Africa. The Asian giant is now the continent’s biggest trade partner and one of its main investors. China is also the largest source of demand for African exports. On the one hand, according to Shen (2013, 3), by the early 2000s, almost all capital from China to Africa represented “international aid.” On the other, a flood of cheap Chinese exports was devastating to Africa’s small manufacturing sector, destroying the clothing, textile, footwear, appliance, electronics, and other sectors in South Africa, Nigeria, Zimbabwe, Zambia, and other countries that had earlier attempted import-substitution industrialization. Most of Africa witnessed a halving of manufacturing output relative to gross domestic product during the 1990s-2000s.

From 2003 onwards, there was more FDI from China, and in the following dozen years, the stock of Chinese investment in Africa soared from $491 million to $32.4 billion (He and Zhu 2018, 10). In 2008, during the world financial crisis, the largest single acquisition in Africa was the $5.6 billion purchase by the Industrial and Commercial Bank of China of a 20 percent share in Standard Bank of South Africa. The China Development Bank made two other large South African loan commitments initially reported at $5 billion each: to the parastatal Transnet in 2013, to buy Chinese locomotives mainly so as to export coal, and to the energy parastatal Eskom in 2016 for a coal-fired power plant. Both were bound up in corruption scandals, the first involving payoffs to the infamous Gupta brothers who “state-captured” the Zuma government and the second, paying for Hitachi boilers after the Japanese firm had given the ruling party a 25 percent share of its local branch (Bond 2020).

In Latin America, Chinese loans totaled $141 billion (80 percent of which were made by the China Development Bank) from 2005-2016, mainly to Venezuela, Brazil, Ecuador, and Argentina. Of these, $74 billion were secured through “loan-for-oil” collateral, and many denominated in renminbi not dollars (CEPAL 2018, 23-24). The danger is a new form of financial dependency, in which China—whose currency strengthened more than nearly any other (making the loans much more expensive to repay)—is progressively more attached to the region’s economies. But this amplifies the more general mode of dependency, as 72 percent of Latin American exports to China in 2016 were primary commodities. (For the rest of the world primary commodities accounted for only 27 percent of the region’s exports, balanced by low-, medium-, and high-tech manufactures [CEPAL 2018, 41].)

Moreover, Chinese firms are increasingly replacing Western extractive corporations that had mastered “unequal ecological exchange,” another major problem with such asymmetrical trade. The term’s use in this instance refers to the uncompensated depletion of nonrenewable raw materials, and in Africa, for example, this process leads to a $150 billion annual wealth outflow, of which a great deal is to China (Bond 2018).

As for FDI, Dussel Peters (2019) estimates that from 2000-18, there were 402 major Chinese investments in Latin America and the Caribbean totaling $8.203 billion, mainly through mergers and acquisitions within the raw materials, manufacturing, and service sectors. Brazil received most of these investments (ten out of the top dozen), directed mainly to the energy sector, followed by Peru, Argentina, and Chile (CEBC 2019, 24). Moreover, China has largely protected its multinational corporations through 128 bilateral investment treaties (BITs) around the world (the second largest number, behind Germany). Since the 1990s, it has signed 34 BITs in Africa and 15 BITs in Latin America and the Caribbean, in addition to bilateral free trade agreements with Costa Rica, Chile, and Peru.

There are important contrasts between China and other BRICS countries, for while the former captured large market shares at the world scale and moved up within global value chains, other countries’ investments are linked more to their own regional value chains and infrastructure networks (UNCTAD 2017, 55). Indian annual FDI abroad peaked at $21 billion in 2008 (with lower rates since), and is mainly focused on natural resources, energy, and services. Two of its most aggressive entrepreneurs, Lakshmi Mittal of ArcelorMittal steel and Anil Agarwal of Vedanta mining, have played extremely controversial roles in South Africa and Zambia, respectively (van der Merwe et al 2019).

To protect the value of (and income stream from) its FDI, India signed 61 BITs, 12 of which are with African countries and another four with Latin America. India has also increased its role in aid, cooperation, technical assistance, peacekeeping missions, and improved cultural relations (Bhatia, 2010). In 2008, the India-Africa Forum Summit allowed the New Delhi government to begin consultations with African heads of state every few years; the 2015 conference attracted 29 leaders. Diplomatic, financial, and legal incentives, together with the substantial Indian diaspora in Africa, have also helped attract Indian investments (Cheru and Obi 2011: 99-100).

In Latin America, Indian FDI is generally low, but has grown in the last years through mergers and acquisitions in oil and gas, sugar, pharmaceuticals, and mining (CEPAL 2016, 56-57; Paul 2012). Trade relations remain uneven, with Africa and Latin America still mainly exporting raw materials, especially fossil fuels, while India supplies them pharmaceuticals and low- and medium-technology products (Anwar 2014; CEPAL 2016, 40-41). In Africa, Indian public and private corporations bought large chunks of land during the early 2010s land grabs, causing conflict with residents (Cheru and Ob, 2011, 103; Anwar 2014).

South Africa is the continent’s largest industrial power and, facing stagnation at home, invests prolifically elsewhere in Africa, especially in telecommunications, retail, manufacturing, mining, tourism, and construction. Some investments date to apartheid, when mining houses such as Anglo American, De Beers, and a Johannesburg predecessor of BHP Billiton (Gencor) established major operations in newly independent Zimbabwe and Mozambique (Amisi et. al., 2015). These three firms relocated away from the Johannesburg Stock Exchange (to London and Melbourne) as democracy dawned during the 1990s. Others moved up-continent including retail leader Shoprite (co-owned by Chinese capital; Carmody 2015), a company known for shutting down local supply chains so as to import their own South African goods—as simple as tomatoes—to their new shops in countries as far away as Zambia (Miller 2005).

Russian firms in Latin America and Africa specialize in natural resources and related infrastructure (Barka and Mlambo 2011). Despite economic restrictions imposed by Western powers after the 2014 Crimea crisis, increasingly modernized investments are offered in technology industries, defense, nuclear energy, and even space exploration. In steel, the firm Evraz—owned by Roman Abramovich (also owner of Britain’s Chelsea soccer club)—was soon notorious for buying, milking, and then in 2016 closing South Africa’s second largest steel company. A privatization program during 2017-2019 meant Moscow sold shares in its large multinationals, including those active in Africa and Latin America such as VTB Bank (quickly implicated in a major Mozambican foreign-debt fraud case), shipping companies, the world’s leading diamond mining corporation Alrosa, and the oil company Rosneft (UNCTAD 2017, 66-69).

Nuclear energy firm Rosatom continues to promise competitively priced technology to several countries (although the fraud associated with its South African associates Jacob Zuma and the Gupta brothers halted that process in 2017). Although sanctions shut Moscow out of World Bank credits, Vladimir Putin did nevertheless sign the Washington Convention to access the bank’s investor-to-state arbitration panel, where it has filed more than twenty cases to protect its 79 BITs and six investment agreements (including 11 in Africa and six in Latin America and the Caribbean).

Politically, Russia’s engagement with Africa dates to Soviet support for national liberation movements, and diverse diplomatic relations have continued (Arkhangelskaya and Shubin 2013, 31). In 2019, Putin hosted the first Russia-Africa Summit, welcoming forty African states, co-sponsored with Egypt’s military coup leader (and then elected president) Abdel Fatah el-Sisi.

In Latin America, apart from historical relations with Cuba, Russia renewed ties with Venezuela and Bolivia (with the latter even signing a $300 million Rosatom reactor contract). Russia’s arms deals in Africa were worth nearly $67 billion in 2011 (Amisi et. al., 2015) and $14 billion in Latin America in 2013 (Ellis 2015: 14). In early 2020, Foreign Minister Sergei Lavrov visited Venezuela in order to help Caracas “deal with growing U.S. pressure,” just a year after Brazil’s right-wing foreign minister had unsuccessfully attempted to draw BRICS into a pro-coup diplomatic stance. Moscow’s economic relations with Europe and China resemble those of a peripheral country, selling raw materials, but when it deals with Africa and Latin America, Russia has characteristics of a “core” capitalist country, exporting high-tech industrial goods.

Finally, Brazil is the main FDI recipient in Latin America but also a major investor on the continent. During Lula da Silva’s Workers Party government from 2003 to 2010, the orientation was to “South-South relations,” which in turn set the stage for Brazil’s more proactive position in multilateral arenas. The right-wing Congress’ unjustified 2016 ousting of Lula’s successor, Dilma Rousseff, and the subsequent rise of far-right Jair Bolsonaro to power in early 2019, caused chaos in Brazilian foreign policy, especially Bolsonaro’s realignment with Washington at the expense of hard-fought-for pro-South diplomatic and economic ties.

Brasilia has an ambiguous position toward Beijing, since Bolsonaro’s allies in export corporations (especially agri-business) need the Chinese market while the president has exhibited Trump-style Sinophobia. When investing abroad, Brazilian multinationals focus on the extractive minerals and energy sectors, infrastructure, industrial machinery, textiles, food, and beverages (FDC 2017). The Brazilian National Development Bank was the main source of funding for the internationalization of Brazilian corporations, but Bolsonaro’s ultraliberal policies reduced its influence.

Brasilia has adopted its own version of a BIT, the Agreement on Cooperation and Facilitation of Investments. Unlike BITs, ACFI doesn’t provide for “investor-to-state” arbitration in conflicts with other states or affected communities (Morosini and Ratton 2015). The Workers Party of Lula and Dilma always emphasized negotiated solutions with host states, in which conflicts were kept out of the spotlight, even though in the cases of Vale mining, Odebrecht construction, and Petrobras oil, corruption and socio-ecological conflict often proved overwhelming. The people of Peru grew impatient, for instance, and Odebrecht’s bribery of its leaders caused a severe backlash when three of the last four presidents were implicated in taking bribes: Two resigned (Alejandro Toledo and Pedro Pablo Kuczynski), and another committed suicide (Alan Garcia).

Conclusion

The rise and fall of the BRICS nations, seen from Latin America and Africa, can be interpreted drawing upon these regions’ radical intellectual traditions, in search of counter-hegemonic knowledge that contributes to structural change in local and global economic affairs. Apart from reproducing core-periphery and dependency relations, the rise of BRICS reinforced the deeply rooted imagery of “modernization” and “development” in an epoch when such projects were being challenged by non-Western scholarship as well as by social movements and adversely affected communities of the South. The “talk left, walk right” problem (Bond 2004) was interpreted by Sam Moyo (along with Amin, one of Africa’s great political economists), when writing with Brazil-based Paris Yeros in 2011 (20) that the BRICS nations’ political “schizophrenia” was “typical of subimperialism’ (Yeros and Moyo 2011, 20).

While demanding reforms in the Bretton Woods multilateral institutions, the BRICS countries also created their own financial institution in 2014: the BRICS New Development Bank. But it too appears to operate much the same as a Western multilateral bank (Bond 2020). In short, the BRICS states complement, and don’t confront, existing financial institutions and multinational corporations by virtue of their own assimilation into global capital accumulation patterns.

Moreover, two obvious rightward political shifts—the Modi (2014) and Bolsonaro (2019) governments—created extreme geopolitical tension and curtailed the rise of BRICS, and the present Sino-Indian border conflict festered in 2020 to the point that dozens of troops were killed in hand-to-hand combat.

The geopolitical terrain may be fluid, but in terms of African and Latin American economies, it appears incontrovertible that BRICS firms’ and leaders’ relations tend to deepen, rather than mitigate, the central features of the world capitalist economy hitherto dominated by the West. To be sure, the COVID-19 crisis introduces major complications, especially when it comes to managing social conflicts and health systems (for instance pharmaceutical markets and research). Inequities are so profound that residents of all the BRICS nations aside from China were incapable of defending their very lives against state incompetence.

As for resistance, beyond merely fighting back against current economic dynamics, progressive activists within the BRICS countries have a profound challenge: better organizing the counter-hegemonic social forces that have potential on the ground, while at the same time exploring the viability of alternative modes of living that protect local communities, peasants, and workers from megaprojects carried out by home-based parastatal corporations and private conglomerates (Bond and Garcia 2015).

As seen above, multinational corporations from BRICS countries, as well as projects financed by BRICS institutions, are reinforcing accumulation patterns that are socially and environmentally predatory, destroying the forms of life and work of populations in their territories. In order to overcome this predicament, South-South relations must be built with profound respect for counter-hegemonic social forces in these countries, as well as at the global scale. The legacy of Latin American and African development theories demonstrates some of the ways of connecting economic theorizing to such concrete political struggles.

References

Amin, Samir (1974). Accumulation and development. Review of African Political Economy, 1, Aug.-Nov., 9-26.

Amin, Samir (1990). Delinking. London: Zed Books.

Amorim, Celso, and Luiz Feldman (2011). A Política Externa do Governo Lula em Perspectiva Histórica. Brasília: Fundação Alexandre Gusmão.

Anwar, Mohamed Amir (2014). Indian foreign direct investments in Africa. Bulletin of Geography. Socio-economic Series, 26, 35-49.

Amisi, Baruti, Patrick Bond, Richard Kamidza, Farai Maguwu, and Bobby Peek (2015). BRICS corporate snapshots during African extractivism. In Bond and Garcia (eds.). BRICS, an anti-capitalist critique. Johannesburg: Jacana Media.

Arkhangelskaya, Alexandra, and Vladimir Shubin (2013). Is Russia Back? Realities of Russian Engagement in Africa. LSE Ideas, 16.

Barka, Habiba Ben, and Kupukile Mlambo (2011). Russia’s economic engagement with Africa. Africa Economic Brief 2, May.

Bello, Walden (2014). The BRICS: Challengers to the global status-quo. Foreign Policy in Focus, 29 Aug.

Benjamin, Medea, and Nicolas Davies (2020). King Joe and the Round Table. CodePink, July.

Biden, Joseph (2020). Why America must lead again. Foreign Affairs, Mar.-Apr.

Bond, Patrick (2004). Talk Left Walk Right. Pietermaritzburg: University of KwaZulu-Natal Press.

Bond, Patrick (2006). Looting Africa. London: Zed Books.

Bond, Patrick (2020). BRICS Banking and the Demise of Alternatives to the IMF and World Bank. In Jose Puppim de Oliveira and Yijia Jing (Eds), International Development Assistance and the BRICS. New York: Springer, pp. 189-218.

Bond, Patrick, and Ana Garcia (Eds) (2015). BRICS: an anti-capitalist critique. Johannesburg: Jacana Media.

Bhatia, Rajiv (2010). India’s Africa policy: Can we do better? The Hindu, 15 July.

Cheru, Fantu, and Cyril Obi (2011). Chinese and Indian engagement in Africa: competitive or mutually reinforcing strategies? Journal of International Affairs, 64, 2.

Carmody, Padraig (2015). The New Scramble for Africa. Jacobin, 19.

CEPAL (2016). Fortaleciendo la relación entre India y America Latina y Caribe, Nov.

CEPAL (2018). Explorando nuevos espacios de cooperación entre América Latina y el Caribe y China, Jan.

CEBC – Conselho Empresarial Brasil-China (2019). Chinese investments in Brazil 2018. Rio de Janeiro, Sept.

Dussel Peters, Enrique (2019). Monitor of Chinese OFDI in Latin America and the Caribbean 2019, Mar. 31.

Desai, Rhadika (2013). The BRICS are building a challenge to western economic supremacy. The Guardian, 2 Apr.

Dollar, David (2019). Understanding China’s Belt and Road infrastructure projects in Africa. Sept.

Ellis, Evan (2015). The new Russian engagement with Latin America. Strategic position, commerce and dreams of the past. U.S. Army College Press. June.

Escobar, Arturo (1995). Encountering Development: The Making and Unmaking of the Third World. Princeton: Princeton U.P.

FDC – Fundação Dom Cabral (2017). Ranking FDC das multinacionais brasileiras 2017.

Garcia, Ana (2017). BRICS investment agreements in Africa: more of the same? Studies in Political Economy 98:1, 24-47.

Garcia, Ana, and Karina Kato (2020). A Road to Development? The Nacala Corridor at the intersection between Brazilian and Global Investments. In BRICS and the New American Imperialism. Global Rivalry and Resistance, edited by Vishwas Satgar. Wits U.P.

Fontes, Virginia, and Ana Garcia (2013). Brazil’s new imperial capitalism. In Leo Panitch, Greg Albo, and Vivek Chibber (Eds.), Socialist Register 2014. London: Merlin Press.

Gudynas, Eduardo (2013). Debates on development and its alternatives in Latin America. In Miriam Lang and Dunia Mokrani (eds.). Beyond Development. Amsterdam/Quito: Transnational Institute/Rosa Luxemburg Foundation.

Harvey, David (2001). The New Imperialism. Oxford: Oxford U. P.

Harvey, David (2007). “In what ways is ‘The New Imperialism’ really new?” Historical Materialism, 15, 57-70.

Harvey, David (2018). Realities on the ground. Review of African Political Economy. 5 Feb.

He, Canfei, and Shengjun Zhu (2018). China’s foreign direct investment into Africa. In UN Habitat, The state of African Cities 2018. Nairobi.

Jaguaribe, Anna (2018). Characteristics and directions of China’s global investment drive. In A. Jaguaribe (Ed.). Directions of Chinese Global Investments. Brasilia: Fundação Alexandre Gusmão.

Kiely, Ray (2015). The BRICs, U.S. ‘Decline’ and Global Transformations. London: Palgrave MacMillan.

Kothari, Ashish, Ariel Salleh, Arturo Escobar, and Frederick Demaria (Eds) (2019). Pluriverse: A Post-development Dictionary. New Delhi: Tulika Books.

Letelier, Orlando, and Moffit, Michael (1977). The International Economic Order [Part 1]. Washington: Transnational Institute.

Luxemburg, Rosa (1968). The Accumulation of Capital. New York: Monthly Review Press.

Marini, Ruy Mauro (1965). Brazilian Interdependence and imperialist integration. Monthly Review, vol. 17, n. 7, Dec.

Marini, Ruy Mauro (1972). Brazilian sub-imperialism. Monthly Review, vol. 23, n. 9, Feb.

Marshall, Judith (2015). Behind the image of South-South solidarity in Brazil’s Vale. In Bond and Garcia (eds.) BRICS, an anti-capitalist critique. Johannesburg: Jacana Media.

Matiwane, Zimasa (2017). ‘I was poisoned and almost died when SA joined Brics,’ says Zuma. The Mercury, 14 Aug.

Miller, Darlene (2005). New regional imaginaries in Post-Apartheid Southern Africa: Retail workers at a shopping mall in Zambia. Journal of Southern African Studies 39, 1. 117-145.

Moyo, Sam, and Paris Yeros (2011). Rethinking the theory of primitive accumulation. Paper presented to the 2nd IIPPE Conference, 20−22 May, Istanbul, Turkey.

Nixson, Fred (1982). Import substituting industrialization. In Martin Fransman (ed.), Industry and Accumulation in Africa. London: Heinemann.

Prashad, Vijay (2013). Neoliberalism with Southern characteristics. The rise of the BRICS. Rosa Luxemburg Stiftung, New York Office, May.

Prebisch, Raul (1950). The economic development of Latin America and its principal problems. Lake Success/New York: United Nations Economic Commission.

Quijano, Aníbal, and Wallerstein, Immanuel (1992). Americanity as a concept or the Americas in the modern World System. International Social Science Journal, vol. 44, n. 4, 549-557.

Quijano, Aníbal (2012). Bien vivir: entre el desarrollo y la des/colonialidad del poder. Viento Sur, vol. 12, May.

Rostow, Walt (1960). The Stages of Economic Growth: A Non-Communist Manifesto. Cambridge: Cambridge U. P.

Santos, Theotonio (1970). The Structure of Dependence. American Economic Review, vol. 60, n. 2, May, 231-236.

Shen, Xiaofang (2013). Private Chinese Investment in Africa. Myths and Realities. World Bank, Policy Research Working Paper 6311, Jan.

Swampa, Maristela (2013). Resource extractivism and alternatives: Latin American perspectives on development. In Miriam Lang and Dunia Mokrani (eds.). Beyond Development. Amsterdam/Quito: Transnational Institute/Rosa Luxemburg Foundation.

Terreblanche, Christelle (2018). Ubuntu and the struggle for an African eco-socialist alternative. In Vishwas Satgar (Ed), The Climate Crisis. Johannesburg: Wits U. P.

UN Conference on Trade and Development (2017). World Investment Report 2017. Investment and the Digital Economy. United Nations, Geneva.

van der Merwe, Justin, Patrick. Bond and Nicole Dodd (eds.). BRICS and resistance in Africa (pp. 47-72). London, Zed Books.

van der Pijl, Kees (2017). BRICS – An involuntary contender bloc under attack. Estudos Internacionais, vol 5, n. 1. 25-46.

Zakaria, Rafia (2013). From Bandung to BRICS. Jacobin, Oct.

Zhang, Pepe (2019). Belt and Road in Latin America: a regional game changer?”. Atlantic Council, Issue Brief, Oct.