The Jobs Crisis: How to Solve It and Begin to Fix Our Broken Economy

The United States has an ongoing jobs crisis that has been crippling our people and our economy for nearly two years. In September 2010, 14.8 million people were officially unemployed, 15.7 million were either forced to work part-time or were jobless and no longer looking for work and another 16.3 million were the working poor. Thus, almost 47 million people were afflicted by unemployment or underemployment (see table 1). Moreover, the numbers multiply when the families of the unemployed are included. Early in the recession, long-term unemployment—27 weeks or more—had reached the highest level since 1948, when the Bureau of Labor Statistics began keeping this record; and it continues high as jobs are shed, new hires are meager and population growth accounts for new job entrants who are unable to find work.[1]

| Table 1. Official Unemployment by Population Group, Hidden Unemployment, Working Poor and Job Vacancies, September 2010 | |

|---|---|

| Official Unemployment: 9.6 percent | |

| Percent | |

| White | 8.7 |

| African-American | 16.1 |

| Men | 18.8 |

| Women | 13.7 |

| Hispanic | 12.4 |

| Asiana | 6.4 |

| Persons with disabilitiesa | 14.8 |

| Men 20 years and over | 9.8 |

| Women 20 years and over | 8.0 |

| Teen-Agers (16-19 years) | 26.0 |

| Black teens | 49.0 |

| Officially Unemployed | 14.8 million |

| Hidden unemployment | |

| Working part-time because can't find a full-time job | 9.5 million |

| People who want jobs but are not looking so are not counted in official statistics | 6.2 million |

| Total Official and Hidden Unemployment | 30.5 million (19.0 percent of the labor force) |

| In addition, millions more worked full-time, year-round, yet earned less than the official poverty level for a family of four. In 2009, the latest year available, that number was 16.3 million, 16.4 percent of full-time, full-year workers. | |

| In August, 2010, the number of job openings was 3.2 million. Thus there were more than 9 job-wanters for each available job. | |

| a = not seasonally adjusted | |

| Sources: U.S. Bureau of Labor Statistics, The Employment Situation in September 2010, http://www.bls.gov/news.release/pdf/empsit.pdft, for unemployment rates; for estimate of working poor, U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, Work Experience in 2008, http://www.census.gov/hhes/www/cpstables/032009/perinc/new05_001.htm ; for job vacancies, U.S. Bureau of Labor Statistics, Job Openings and Labor Turnovers-August 2010, http://www.bls.gov/news.release/pdf/jolts.pdf | |

Although the current emergency’s proximate cause is the financial meltdown of 2008, there are serious underlying problems in the U.S. economy that pre-date the collapse. In our view, steeply rising economic inequality and its political consequences, beginning in the mid-1970s and gathering force in subsequent decades, are major contributors to the emergence of these problems and the failure to deal with them effectively. We believe it is essential to take action to end the immediate jobs crisis, not only because more than 30 million people are directly afflicted but also because it is a terrible drag on the entire economy. Simultaneously, we must confront the problems that pre-date the meltdown. These must be addressed if we are to avoid more Great Recessions.

The Jobs Crisis and Recovery

The persistence of very high unemployment retards economic recovery. As economist Philip Harvey has observed, "once established, a swollen job shortage tends to perpetuate itself."[2] Harvey points to some specific ways in which unemployment is prolonging the current recession:

It is preventing the housing market from rebounding and the housing industry from recovering. It’s keeping the consumer sector waiting anxiously for customers. It’s keeping capital goods producers waiting for a growth sector to serve. And it makes the financial sector fearful to lend. Businesses may invest on the margin in response to increased tax and regulatory incentives, but until they see customers with money to spend on the horizon, their appetite for risk will remain limited.[3]

It is thus imperative that we pursue policies to significantly reduce unemployment.

Even in the year 2000, when official unemployment was the lowest in 30 years, 13 million people or 9 percent of the labor forces were either officially unemployed or hidden unemployed (Table 2). In that year nearly 16 million people or 16.8 percent of full-time, full-year workers were earning less than the official poverty level for a family of four. And there were many more persons wanting work than there were job vacancies, about 3.5 to one.

| Table 2. Official and Hidden Unemployment by Population Groups, 2000 | |

|---|---|

| Official Unemployment: 4.0 percent | |

| Percent | |

| White | 3.5 |

| African-American | 7.6 |

| Men | 8.2 |

| Women | 7.2 |

| Hispanic | 5.7 |

| Asiana | 3.6 |

| Men 20 years and over | 3.3 |

| Women 20 years and over | 3.6 |

| Teen-Agers (16-19 years) | 13.1 |

| Black teens | 24.5 |

| Officially unemployed | 5.7 million |

| Hidden unemployment | |

| Working part-time because can't find a full-time job: | 3.2 million |

| People who want jobs but are not looking so are not counted in official statistics | 4.2 million |

| Total Official and Hidden Unemployment | 13.1 million (9.0 percent of the labor force) |

| anot seasonally adjusted | |

| Source: For official and hidden unemployment, U.S. Bureau of Labor Statistics, Employment and Earnings, 48, 1, January 2001, tables 3, 5, 20, 35. | |

The official unemployment rate of black men was 8.2 percent, exactly the percent for the total labor force in February 2009 that was considered sufficiently high for Congress to enact the $787 billion American Recovery and Reinvestment Act (ARRA) or Obama’s stimulus. Official unemployment statistics are of the civilian, non-institutional population. In 2000, a third of African-American young men who were high school dropouts were incarcerated. If they had been included in labor force calculations, the unemployment rate of African-American men would have been almost one-third, even in that year of record-low official unemployment.[4] Chronic unemployment, averaging 6.5 percent (official) from 1974 to 2008, contributed to growing inequality in the U.S. and to a 13 percent decline in average hourly wages (in constant dollars) between the mid-1970s and the meltdown.[5] Men over the age of 55 have a particularly difficult time regaining employment after becoming unemployed.[6]

Since the 1970’s, unstable and contingent employment, most of it involuntary, with low wages, few benefits and little opportunity for training leading to promotion has been growing faster than stable, full-time work. Not surprisingly, this portion of the workforce is composed disproportionately of women, minorities and both young (under 24) and old (over 65) workers.[7] Related to this trend has been an increase in jobs that are contracted out and in day labor and swing shift work with short and irregular work schedules.[8] Low-waged laborers, especially immigrant women, are routinely subjected to harsh working conditions and violations of wage and hour laws, and child care workers were heavily represented among exploited low-wage workers.[9] A concern as we advocate for good jobs at livable wages is the finding that between 2006 and 2009, of the five fastest growing occupations, all except nursing were clustered at the low end of the wage scale; food service and home health work in which pay was barely above the minimum wage grew the fastest.[10]

The Right to a Job at Livable Wages

Some progressives called attention to the chronic unemployment problem prior to the meltdown and the jobs crisis. It was their belief that the right to a job at livable wages is a basic human right. They were inspired by Franklin Roosevelt’s Economic Bill of Rights and the Universal Declaration of Human Rights that owed much to the leadership of Eleanor Roosevelt. First unveiled in Roosevelt’s 1944 State of the Union Address, the Economic Bill of Rights begins with the right to living-wage employment.[11] The Universal Declaration of Human Rights included a broad conception of employment rights: "Everyone has the right to work, to free choice of employment, to just and favourable conditions of work and to protection against unemployment."[12]

Concerned that chronic unemployment was depriving millions of people of what they considered to be a human right, those calling attention to the problem were advocating an active labor market policy. In addition to temporary unemployment compensation for temporary job loss or a passive labor market policy, they envisioned a standby program in which jobless workers would be employed by government to perform much needed work. They argued in terms of "double deficits." On the one hand there was a jobs deficit with millions of people needing work. The other deficit was in public investment, which had fallen precipitously to half of its 1960s’ and 1970s’ levels in relation to the size of the economy. To deal with the consequent deficiencies in the physical and social infrastructure, jobless women and men could be employed at living wages to renovate dilapidated housing and schools; build and repair bridges, roads, and levees; provide child and elder care; expand recreational and cultural activities; improve parks and other public spaces; and undertake energy conservation.[13]

It is important to point out that those who were proposing active labor market policies before the meltdown did not think that these policies should stand alone. Necessary, complementary policies included protection and expansion of government’s ability to regulate corporations in the public interest; restoration of progressive taxation; assurance of collective bargaining rights; renegotiation of global agreements to include labor rights; environmental protection; and environmental sustainability.

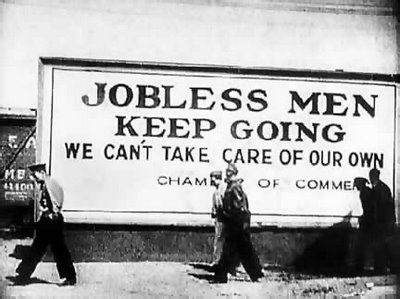

Lessons from The New Deal

In their dual focus on the need for jobs and on the need of the nation to repair and rebuild and expand a deficient physical and social infrastructure, these proposals resembled innovative New Deal programs such as the Civil Works Administration (CWA) and the Works Progress Administration (WPA). Path breaking as it was, the New Deal model for job creation was flawed in certain important respects. Not the least of these was that it reflected the deeply entrenched racism and sexism of their time. African-Americans were believed to be accustomed to low wages and were required to accept lower-paying jobs than whites; they were classified as unskilled labor no matter what their skill levels.[14] While women were one-fourth of the labor force, only one-sixth of WPA jobs went to women.[15] When women did get a slot in a work program, they were paid lower average wages than white men, $3 a day, compared to $5 for men.[16] Twenty-first century work programs must serve disadvantaged groups in proportion to their need and pay them according to their worth, but in any case, a living wage. Whereas New Deal programs tended to emphasize the physical infrastructure, current proposals also advocate spending for the social infrastructure: child and elder care, education and health care, sectors that employ women disproportionately.

In addition to these shortcomings, New Deal work programs were insufficient to employ even half of the unemployed and were temporary despite continuing, high unemployment. According to New Deal historian William Leuchtenburg, "by any standard [WPA] …. was an impressive achievement, [but] it never came close to meeting Roosevelt’s goal of giving jobs to all who could work."[17] At its peak, the WPA employed fewer than half of the unemployed, and from 1935 to 1941, the various work programs employed on average between one-quarter and one-third of the estimated unemployed…."[18] New Deal historian Irving Bernstein wrote "throughout its history, both the President and the Congress considered WPA … a temporary if not emergency agency slated for oblivion as soon as severe unemployment disappeared."[19] But Harry Hopkins, the administrator of the work programs, believed that unemployment would not be solved by temporary measures and would be a problem for many years to come.[20] FDR’s Secretary of Labor Frances Perkins recalled that Roosevelt and Hopkins did want a permanent work relief program, but, writing in the mid-1940s, she observed that "unemployment insurance stands alone in the protection of people out of work."[21] It continues to stand alone, and so we have a passive labor market policy of income support for temporary unemployment but not an active labor market policy that would put the long-term unemployed to work in service to the nation.

Has the Obama Stimulus Failed?

How does the $787 billion Obama stimulus compare with these proposals for direct job creation? The American Recovery and Reinvestment Act (ARRA) was supposed to save or create three to four million jobs. In February 2009, when it was enacted, 12.7 million people or, as noted, 8.2 percent of the labor force were officially unemployed. Between February and October 2009, unemployment shot up by nearly three million, and the rate climbed to 10.1 percent, the highest for any month since the meltdown. In September 2010, 19 months after the stimulus was enacted, the unemployment rate was still hovering around 10 percent (9.6 percent) and the number of jobless individuals was somewhat higher than in the previous October. Does that mean that the Obama stimulus was a failure? The reviews are mixed. Paul Krugman argues that the stimulus was not big compared to the size of the economy and was not focused on increasing government spending by much. He points out that 40 percent of the $600 billion of stimulus money spent in 2009 and 2010 was consumed by non-productive tax cuts. Another huge chunk was used to save jobs of state and local public sector workers such as teachers, but this was not enough to offset the cuts that these jurisdictions were forced to make because of declining tax revenues in the recession. Only the remainder involved direct federal spending.[22] Christina Romer, then head of Obama’s Council of Economic Advisers, originally estimated that a stimulus of $1.2 trillion was needed, but presidential aides considered that too high, and the proposal never reached the President.[23] It can be inferred that the size of the stimulus doomed it to failure.

The ARRA did do some good. According to an estimate of former Federal Reserve Board vice-chair Alan Blinder and Mark Zandi, chief economist at Moody’s Analytics, unemployment would have climbed to 16 percent instead of about 10 percent without the combined effect of the bank bailout and the Obama stimulus.[24] Nonetheless, Blinder has acknowledged that we’re in a "jobs emergency" that requires New Deal-style hiring of workers onto public payrolls.[25] The Obama stimulus was not a complete failure, but unemployment remains near double digits.

Economist Philip Harvey takes the position that the $787 Obama stimulus could have reduced official unemployment far more if it had been devoted to direct job creation. In addition to its indirect stimulus to the economy that saved or created millions of jobs, the money could have directly created an additional 7 million full-time jobs, paying the same wages as those earned by similarly qualified and experienced workers in the regular labor market and each lasting two years at the cost of $55,000 per job (including materials and supplies).[26] Harvey’s proposed wage averages $14.52 per hour for program participants; we prefer a higher wage. Harvey’s estimates may not take into account today’s obstacles to the implementation of government job programs — some of them necessary regulations like environmental-impact reports and historic-preservation safeguards.[27] Federal funds have largely been distributed through state bureaucracies that, like the federal agencies, are large and slow moving. For instance, an analysis of the implementation of the ARRA in California found that grants from the federal departments of Energy and Transportation were the slowest to be implemented.[28] The National Association of Towns and Townships has complained that small jurisdictions have been neglected in the process of funding distribution that has required going through state bureaucracies, a process the organization considers unfair and wasteful.[29]

In the 1930s, when the federal bureaucracy was much smaller than today, F.D.R. created a separate agency to administer work programs under the gifted and non-bureaucratic direction of social workers Harry Hopkins and Aubrey Williams. The approaches of Presidents John F. Kennedy and Lyndon B. Johnson resembled this part of the New Deal model in establishing new agencies like the Peace Corps and the Office of Economic Opportunity to plan and implement innovative programs. We believe that a federal attack on unemployment can work most efficiently by creating a new, separate federal agency empowered to create jobs directly (admittedly, the details of such an agency have yet to be worked out). A program of this size for direct job creation has never been tried, but there are precedents for believing it would be effective.

It will, however, be very difficult to make the case for more government spending at this point. One reason, but not the only one, is the perceived failure of the Obama stimulus. The case for more federal spending is made still harder by the anti-government assault of right-wing politicians and economists, the latter of whom raise alarums about the rising debt and deficit. Although Wall Street and millions of investors were saved by a massive federal government bailout, they continue to bite the hand that fed them by bashing government aid. And much of the public also overlook the fact that government programs like unemployment insurance and food stamps are feeding, clothing and paying the bills for millions of the unemployed and in so doing are keeping consumption from dipping even lower and unemployment even higher.

The Deficit Obstacle

Obsession with the budget deficit blocks our path, particularly when unemployment remains close to 10 percent after a multi-billion dollar recovery program. In fact, more money has to be spent to cure unemployment, at least initially. There would be some savings from the program as a result of decreased outlays for unemployment insurance and other income support programs, taxes paid by the workers, the increased purchasing power of the workers that would stimulate other job creation and reduced costs of the social problems caused by unemployment. Nonetheless the start-up and perhaps continuing costs could be substantial.[30]

The dilemma is how to approach the deficit in gaining support for these start-up costs. On the one hand, we can tacitly admit the deficit is important, economically as well as politically, by coming up with such alternative revenue sources as cutting military spending to actual defense needs, rescinding the tax cuts to the rich and a stock transfer tax. The nonpartisan Joint Committee on Taxation has estimated that the federal government would collect an additional $238 billion in 2011 if the so-called Bush tax cuts are allowed to expire at the end of 2010.[31] That would provide enough additional funding to create just over 7 million full-time equivalent jobs lasting 12 months each.[32]

On the other hand, we can discredit the attacks on the deficit. That would mean to deny that it is important economically and to point out, as James Galbraith has, that deficit phobia is cultivated by the banks and their proxies in government because private borrowing means money in the pockets of private lenders and public borrowing puts money in the pockets of people with no obligation to repay.[33] Galbraith holds that the analogy between a family budget and a government budget is a false one and should be debunked. Private borrowers can and do default. With the U.S. government, the risk of non-payment doesn’t exist. Although it may sound glib, it is nonetheless true that the U.S. government can spend money and pay interest simply by typing numbers into a computer. Since it is the source of money, the U.S. government cannot run out.[34] The only time that deficits are a problem is at full employment where there could be more demand for goods and services than could be met, with a resultant inflation in wages and prices.[35] This is hardly the case or the threat now.

We can also point out that those who created the deficit by reducing taxes and waging war — remember we had a budgetary surplus in 2000 — are the very ones most obsessed with it. Robert Eisner suggests a motive for deficit hawks that has nothing to do with the need for balancing the budget and from which motives for increasing it can be inferred:

Most conservative economists do not really care about the deficit. They advocate balanced budgets because their real desire is to cut government spending, particularly on the "social programs" they abhor. And that shows up the worst effects of deficit paranoia. It is used to justify depriving the American people of their health care, their education and all of the public investment on which their future depends.[36]

Eisner also points out that deficits don’t have to be repaid and seldom are. The federal debt or accumulated deficits, he observes, were well over 100 percent at the end of World War II, ushering in an era of prosperity and growth.

A less radical position on the deficit is that the real culprit is the recession that reduces income and tax revenues and costs the government in increased benefit expenditures, such as unemployment compensation and food stamps. The Great Recession was responsible for 61 percent of the deficit in 2009, and every million jobs created reduce the deficit by $54 billion.[37]

Of course, it may be impossible to disabuse the public of the dangerous myth that has been perpetrated by the Concord Coalition, Robert Rubin, and the like. This is too bad because ending deficit phobia would unfreeze government money to meet other needs, for example, to pay for social welfare programs, reindustrialization, and conversion to a sustainable economy. A successful movement to debunk the deficit or to put it in its place would be a major contribution to a better society

We believe that those who recognize that recovery won’t happen without a massive federal program should employ a combination of two approaches: downgrading the deficit and trying to explain it but also promoting alternative sources. However, the bigger stimulus would come, not from cutting spending at this point, but spending more. Cutting spending in 1937 led to a "depression within a depression" the following year, a rise in unemployment from 14 to 19 percent. It was the external threat of World War II that forced the Roosevelt administration to spend enough to end the Great Depression.

Some Long-Run Challenges to a Fair and Sustainable Economy

After a period of post-World War II prosperity that was greater than any in our history, a time of "shared prosperity," the U.S. economy began to experience a profit squeeze. Between 1965 and the late 1970s, there was a drop of 40 percent in the average net after-tax profit rate of domestic nonfinancial corporations.[38] Contributing to a new phenomenon known as stagflation or an unusual combination of stagnation and inflation, were the inflationary 1973 OPEC oil embargo, increased competition from Japan and European nations whose war-shattered economies had by then recovered, and the failure to raise taxes to pay for the Vietnam War. American industry did not respond by stepping up investments that would make the U.S. economy more competitive. Instead, corporate America pursued alternative strategies that weakened the manufacturing sector, contributed to the financialization of the economy and resulted in a level of economic inequality and consequent political inequality that can only be compared to earlier periods of egregious inequality and consequent boom and bust — the Gilded Age of the 1870s and the "roaring twenties."[39]

In response to the profit squeeze, business squeezed labor — through wage freezes and new work arrangements that increased the flexibility with which workers could be hired, fired, and scheduled. Organized labor, weakened by the Taft-Hartley Act of 1947 and anti-Communist attacks in the following decade, had declined in density (percentage of non-supervisory workers who are union members) by one-third between 1950 and 1973 and was in no position to resist effectively. Deprived by anti-Communist purges of the movement’s most progressive leaders who would have been more aggressive in organizing women and minorities in the burgeoning service sector, labor was further weakened by the frontal attack of Ronald Reagan, who fired striking federal air controllers (at the same time denying them food stamps). Contributing to a loss of manufacturing jobs and decline of that earlier engine of U.S. economic growth were globalization or transfer of capital and business operations to lower-wage areas of the world and abandoning of production for financial operations. For example, General Electric sold off its consumer appliance manufacturing division and concentrated on its more profitable credit corporation. Still another response of business was to lobby government to reduce taxes and regulations and to encourage globalization.

Through an unprecedented political mobilization, the business community and its allies in the media and academia sought to re-legitimate the free market and to effect a return to government that keeps its hands off the economy. At the beginning of the seventies a handful of Fortune 500 companies had lobbyists in DC, but by the end of the decade, 80 percent were represented in the nation’s capital.[40] Election campaigns came to be dominated by large donors, and the increasing amounts of money spent in election campaigns — from an average of $610,000 spent by winning Senate incumbents in 1986 to $4.4 million in 2000[41]— bought business enormously increased influence. Huge donations by a burgeoning financial sector bought de-regulation and consequently a scant brake on dangerous speculation and predatory lending to a middle- and working class strapped by economic decline and obliged to spend more on items like child care and housing than in the post-war decades.[42]

The administration of Democrat Bill Clinton symbolizes how far the party of the New Deal had strayed from friendliness to ordinary Americans. Clinton presided over the repeal of the quintessential banking regulation of the Great Depression, the Glass-Steagall Act, and over trade agreements that favored business at the expense of the environment and workers, not to mention repeal of public assistance to poor women and their children. With their increased influence over the political process, business interests successfully resisted increases in the minimum wage. And business interests could also retard recognition and policies to deal effectively with an environmental crisis that posed not only limits to economic growth but threatened life as we know it on the planet.

The inter-related economic and political inequality of the last three decades has left the country with an enormous challenge. There is the immediate crisis that must be dealt with decisively in order to get beyond the Great Recession, itself related to de-regulation and to economic inequality and the stranglehold of capital on political democracy that has recently been increased by the Supreme Court’s recent decision forbidding the government from limiting campaign contributions.[43] Direct job creation by government—sufficient to bring down unemployment to an interim goal of 4 percent — would revive the economy and restore the faith in government that we need in order to solve some other long-term problems. Depending on the type of jobs that are created, we can make a move toward greening the economy and can also begin to develop physical and social infrastructures that support a more efficient economy and a better-educated, better cared for and healthier population and workforce. Setting wages at a decent level in the work programs could also have a salutary effect, leading both to needed increases in the minimum wage as well as further up the pay-scale.

Re-industrialization is essential to revival of a U.S. economy that has become under-developed. Economists Robert Pollin and Dean Baker have proposed a plan for a large-scale commitment to public investment projects that would both revive manufacturing and transform the U.S. into an environmentally clean economy.[44] For example, they propose such short-term projects as a 50 percent increase in energy efficient public bus transportation that would reduce burdensome costs of auto commuting, cut consumption of fossil fuels and emission of greenhouse gases and boost the auto industry. Longer-term projects are also envisioned. Pollin and Baker also point out that investment in traditional infrastructure and clean energy can produce far more jobs for million dollars spent than for investment in the military or fossil fuel industries. Enlightened public investment can do much to create decent jobs in the short and longer run and at the same time enable us to develop an economy that is both productive and sustainable.

Footnotes

1. Catherine Rampell, "Bleak outlook for long-term unemployed," New York Times, July 1, 2010, Economix, Accessed July 29, 2010; Motoko Rich, "U.S. Lost 131,000 Jobs as Governments Cut Back," New York Times, April 6, 2010. Accessed October 28, 2010.

2. Philip Harvey, "A Job-led Recovery Strategy." Camden, NJ, Rutgers School of Law, 2010. pharvey@camden.rutgers.edu.

3. Ibid.

4. Bruce Western, Punishment and Inequality in America, (N.Y.: Russell Sage Foundation, 2007), pp. 89-90, calculated from U.S. Census Bureau Household Survey.

5. U.S. Bureau of Labor Statistics, Civilian Unemployment Rate, Monthly, 1948-2010; U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics. (2009a). Historical hours and earnings. Washington, DC: Author. Retrieved March 29, 2010. ftp://ftp.bls.gov/pub/suppl/empsit.ceseeb2.txt.

6. Andrea Orr, Older men face long job searches. Washington, DC: Economic Policy Institute, June 17, 2010. Retrieved October 25, 2010.

7. Polly Callaghan and Heidi Hartmann, (Washington, D.C: Economic Policy Institute, 1992), Contingent Work: A Chart Book on Full-Time and Temporary Work.

8. Matthew Day, Susan Houseman and Ann Polivka, "What do we know about Contracting Out in the U.S.?" (Kalamazoo, MI: Upjohn Institute, Staff Working Paper No. 09-157, 2nd rev., Sept. 09); Abel Valenzuela, Jr., Nik Theodore, Edwin Melendez and Ana Luz Gonzalez, January 2006. On the Corner: Day Labor in the United States, UCLA Center for the Study of Urban Poverty; Ruth Milkman, "Flexibility for Whom? Inequality in Work-Life Policies and Practices" in Ann C. Crouter and Alan Booth, Eds., Work-Life Policies, (Washington, D.C.: The Urban Institute Press, 2009).

9. Annette Bernhardt et al., Broken Laws, Unprotected Workers: Violations of Employment and Labor Laws in America’s Cities. (Chicago: Center for Urban Economic Development; New York City: National Employment Law Project and Los Angeles: Institute for Research on Labor and Employment, 2009).

10. Kai Filion and Andrea Orr, "Jobs…but Low Pay." (Washington, D.C.: Economic Policy Institute, Aug. 27, 2010).

11. Franklin D. Roosevelt. State of the Union Address, January 11, 1944.

12. United Nations. (1948). The Universal Declaration of Human Rights, Article 23.(New York: Author).

13. Charles Bell, Helen Lachs Ginsburg, Gertrude Schaffner Goldberg, Philip Harvey, and June Zaccone, Shared Prosperity and the Drive for Decent Work. New York, National Jobs for All Coalition; Helen Lachs Ginsburg and Gertrude Schaffner Goldberg, Decent Work and Public Investment: A Proposal. New Labor Forum, Spring, 2008, pp. 123-133; Ron Baiman, William Barclay, Sidney Hollander, Joe Persky, Elce Redmond, and Mel Rothenberg, A Permanent Jobs Program for the U.S.: Economic Restructuring to Meet Human Needs. Chicago, Chicago Political Economy Group, February 2009.

14. Nancy Rose, Put to Work: The WPA and PublicEmployment in the Great Depression, 2nd. Ed., (New York: Monthly Review Press, 2009).

15. Ibid.

16. Alice Kessler-Harris, Out to Work: A History of Wage-Earning Women in the United States, (New York: Oxford University Press, 1982).

17. William Leuchtenburg, Franklin D. Roosevelt and the New Deal, 1932-1940. (New York: Harper, 1963), p. 130.

18. Arthur E. Burns and Edward A. Williams, Federal Work, Security, and Relief Programs, Research Monograph XXIV, Federal Works Agency and Work Projects Administration. (Washington, DC: U.S. Government Printing Office, 1941), p. 74.

19. Irving Bernstein, A Caring Society: The New Deal, the Workers, and the Great Depression. (Boston: Houghton Mifflin, 1985), p. 149.

20. June Hopkins, Harry Hopkins: Sudden Hero, Brash Reformer (New York: St. Martin’s Press, 1999), pp. 184, 189.

21. Frances Perkins, The Roosevelt I Knew (New York: Viking Press, 1946), pp. 188-189.

22. Paul Krugman, "Hey, Small Spender," New York Times, October 10, 2010, p. A23.

23. Ryan Lizza, "Inside the Crisis: Larry Summers and the White House Economic Team. New Yorker, October 12, 2009, pp. 80ff.

24. Alan S. Blinder and Mark Zandi. "How the Great Recession Was Brought to an End," July 27, 2010. Retrieved September 25, 2010,

25. John Harwood, "Mystery for White House: Where Did the Jobs Go? "The Politics and Government Blog of the Times. July 19, 2010. Retrieved October 7, 2010.

26. Philip Harvey, Learning from the New Deal. Camden, NJ, Rutgers School of Law, July 20, 2010. pharvey@camden.rutgers.edu

27. Harold Meyerson, “Work History: Why America Needs—But Probably Won’t Get—a 2010 Version of the Depression-era Public Jobs Programs,” American Prospect, May 10, 2010.

28. Ibid.

29. National Association of Towns and Townships, 2010 Federal Platform (author).

30. Harvey, 2010 [see note 26].

31. Lori Montgomery, “GOP Plan to Extend Cuts for Rich Adds $36 billion to Deficit, Panel Finds,” Washington Post, August 12. Retrieved October 8, 2010.

32. Harvey, 2010 [See note 2]

33. James Galbraith, "In Defense of Deficits." The Nation, March 22, 2010, 2-4.

34. Ibid.

35. Robert Eisner, "Why the Deficit Isn’t All Bad: Balancing Our Deficit Thinking." The Nation, December 11, 1995, pp. 743-745

36. Ibid., pp. 744-745.

37. Our Fiscal Security, "The Budget Deficit and the Debt: What You Need to Know.”

38. Bennett Harrison and Barry Bluestone. The Great U-turn: Corporate Restructuring and the Polarization of America. New York: Basic Books, 1988, citing Samuel Bowles, David M. Gordon, and Thomas E. Weiskopf, "Power and Profits: The Social Structure of Accumulation and the Profitability of the Postwar U.S. Economy," Review of Radical Political Economics, 1985, 18, pp. 1-2.

39. Kevin P. Phillips, The Politics of Rich and Poor: Wealth and the American Electorate in the Reagan Aftermath (New York: Random House, 1990).

40. William Greider, Who Will Tell the People? The Betrayal of American Democracy (New York: Simon & Schuster, 1992).

41. Kevin P. Phillips, Wealth and Democracy: A Political History of the American Rich (New York: Broadway Books, 2002).

42. Elizabeth Warren and Alma W. Tyagi, The Two-Income Trap: Why Middle-class Mothers and Fathers Are Going Broke (New York: Basic Books, 2003).

43. Citizens United v. Federal Election Commission, January 21, 2010.

44. Robert Pollin and Dean Baker, "Reindustrializing America: A Proposal for Reviving U.S. Manufacturing and Creating Millions of Good Jobs." New Labor Forum, Spring 2010, pp. 17-34.